Learn How a Gold IRA Can Protect Your Retirement

Midland Trust is well equipped to provide a solution to investors wishing to diversify their retirement accounts into tangible assets like precious metals. However, in this section, we will walk you through the criteria we used to select our top 5 gold IRA companies. They are one of the largest and most trusted custodians available for self directed IRAs. Of Virginia Beach, VA rated 5 stars on Yelp. This consent is not required to obtain products and services. The management of your IRA.

CLOSED LOANS

A gold IRA company allows you to open and maintain a self directed individual retirement account by holding physical gold and/or other precious metals. Goldco offers physical asset purchases, IRA rollovers, and precious metal IRAs. Gold is generally regarded as a safe investment. Gold is generally regarded as a safe investment. Their dedication to helping customers make the best gold IRA decisions is unmatched in the industry, making them one of the best gold IRA companies. This webpage features market updates and important information about gold and silver bullion. Their expertise in the precious metals market is unparalleled, and their customer service is second to none. Compare this to other Precious Metals IRAs that store your bullion thousands of miles away, where access is difficult if not impossible. No, as the IRA holder, you get to choose the dealer and the type of product you want.

Investing In Precious Metals with Noble Gold

Find a facility that is both nearby and best suits your needs and financial situation. GoldStar is not affiliated with any precious outlookindia metal dealers and receives no compensation from investments made for your account. They are a leader in precious metal investments and have supplied customers with high quality service for many years. They understand that each investor’s financial situation is different, and they work diligently to provide solutions that meet individual needs. Their loyal base of customers who return for repeat business is a clear indication of their commitment to customer satisfaction. Precious metal offerings include Gold, Silver, Platinum and Palladium. Sovereign mints include.

1 oz Australian Silver Koala – Random Year

In conclusion, withdrawing from a Precious Metals IRA requires following the standard retirement account protocol of documenting each phase from requisition to disposition surrounding regulations and requirements while managing expectations according to specific circumstances. The intent is to stop account holders from using or accessing IRA assets for personal benefit because doing so would be tantamount to a fully taxable distribution. Since not all investors have experience with precious metals IRAs, a gold IRA company should focus on educating investors about gold IRAs, including how they work, the metals eligible for investment, and their risks and rewards. If you think you may want to sell the gold or other precious metal products in an IRA prematurely, look for a precious metals IRA company that offers a buy back program. This sort of asset is priceless in times of economic instability. The government wouldn’t want this financial instrument to serve as a conduit for tax related fraud and abuse, after all. Goldco also offers a free guide to self directed IRA investing which you can request through a download off their website.

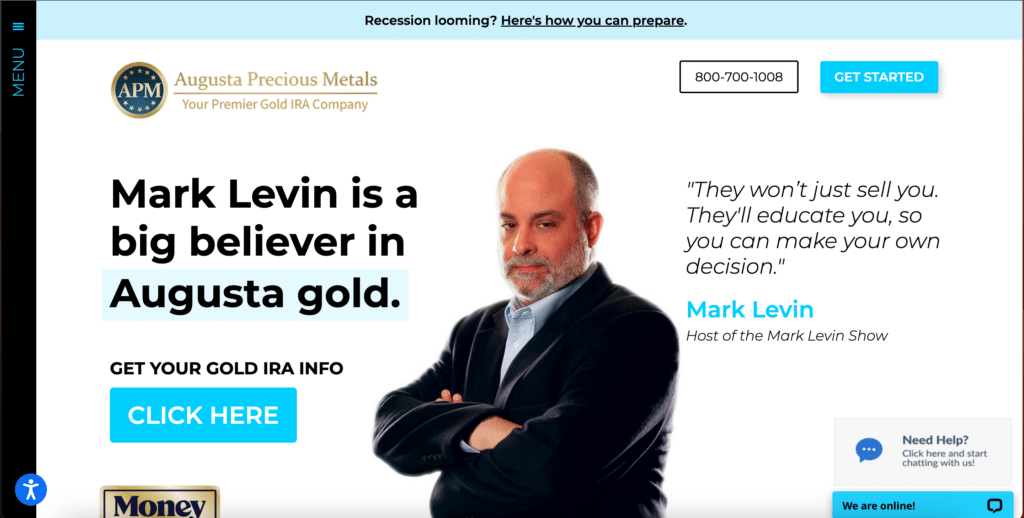

3: Augusta Precious Metals

Apple and the Apple logo are trademarks of Apple Inc. We also covered the fineness standards required for each of these precious metals. American Hartford Gold Group will not charge you to set up your own individual retirement accounts. Plus, we take interest in your investment. Fees: $260 for the first year, then $180 per year. It offers a wide range of services and features such as secure storage and flexible investment options, all of which are designed to maximize returns and protect clients’ investments. They offer a high level of customer service and low minimum investment requirements. Here’s a basic step by step list of how to open a gold IRA with most companies. Another significant distinction is that traditional IRAs typically have annual contribution limits of $5,500 or $6,500 for those over 50. The company’s IRA silver services offer investors a secure and reliable way to diversify their portfolios with silver, making it an ideal choice for those looking to invest in the precious metal. The company also offers a variety of retirement plans such as traditional, Roth, and SEP. Take into consideration these important points. The company is renowned for its expertise in the gold IRA industry and its commitment to providing customers with quality service and secure investments.

Related Articles About Gold and Silver IRA

You’ll easily get a feel for who makes you feel comfortable. American Hartford Gold Group is a trusted gold IRA company with over 25 years of experience in the industry. As we have outlined, there are numerous costs associated with maintaining a precious metals IRA. Unlock the Benefits of Patriot Gold Club Today and Enjoy a World of Financial Security. You can find out more about this complex system on InvestingInGold. Most of the time, some companies will promise to purchase the metal for you at an affordable rate or a certain market price, hence, you will have you wait for a month or two or even three months before having your metal being delivered to you. With Advantage Gold, clients can rest assured that their gold IRA rollover is handled with the utmost care and expertise. Select the type of gold you want to purchase from the approved list of coins and metals. You can fill out the form on the company’s website for a free gold and silver information guide. Is now the time for you to refinance. If you use your IRA for only gold, silver, palladium, and platinum, you are defeating the very purpose of diversification. Speak to your financial advisor.

Augusta Precious Metals: IRA Accounts Silver IRA

The practical concern is finding an IRA trustee who’s willing to set up a self directed IRA and facilitate the physical transfer and storage of precious metal assets. Overall, IRA approved silver can offer a secure and tangible asset that can help protect an individual’s retirement savings from market volatility and economic uncertainty. Experience the Quality and Value of Augusta Precious Metals Today. If you’re looking for a simple way to purchase physical precious metals or start your gold IRA investing journey, Noble Gold is a solid place to start. The theory here is that letting a client know how much they can spend with Augusta regularly makes them more prepared for what lies ahead. It’s no surprise that Augusta Precious Metals has hundreds of 5 star reviews across BBB, Trustlink, and BCA. ” However, unless the company is registered as an exchange with the CFTC, or actually delivers the metal within 28 days, this sort of leveraged transaction is a violation of the Commodity Exchange Act, and may be a fraud. Monitor your investment: You can contact your precious metals specialist at any time for updates about your investments and to receive an up to date buy back quote. I am extremely satisfied with the service provided by Goldco. This conference is available to the public and helps investors understand the ins and outs of investing in gold IRAs. Hedge against inflation: Gold has historically been a reliable hedge against inflation, which can erode the value of paper currency over time. However, there is a yearly maintenance fee of $180.

Oxford Gold Group: Cons Silver IRA

Solid diversification option with a history of outshining traditional assets. It is always wise to understand your decision before investing in a precious metal IRA. Invest in Your Future with Noble Gold: Secure Your Financial Freedom Now. Since your IRA cannot be the seller and holder of the gold, they will need to store the physical gold with a third party. Goldco is one of the reputable IRA companies on the market. Therefore, customers can get help when opening their gold IRAs.

Palladium

Not all financial services companies offer IRAs in which you can buy physical gold or silver. Gold IRAs typically hold gold coins, gold bars, and other forms of gold bullion such as American Eagle coins, Canadian Maple Leaf coins, and South African Krugerrand coins. In a rollover, your existing IRA custodian will give you the money you wish to withdraw, and then you’ll have 60 days to deposit the funds into your new gold IRA account. Hours of Operation PST:M Th: 7:00 A. They’ve been in business over a decade and have racked up hundreds of positive customer reviews online. The company chose Texas as its storage location for a few reasons. The reasoning here is simple: every other company offers roughly the same set of perks and advantages as well as services and features. A: Investing in gold through a gold IRA can provide many advantages. The company prioritizes. We’ll help you compare cover and find the savings you need. This includes information about fees, charges, and transaction related expenses. Get Up to $15,000 in Free Gold Call to Learn More.

Resources and support

The Wall Street Journal recently reported on the radio advertising that promotes an ability to store gold owned by a self directed IRA at the IRA owner’s own home. The company also has a great buy back program. Anyone considering opening an IRA should research the different types of accounts to choose the one that best suits their needs. Essentially, you are expected to spend as much as $300. Finally, Gold IRA investors need to beware of fraudsters who may try to take advantage of them. Their website is user friendly and offers a wealth of information on investing, economics, and precious metals IRAs. American Hartford Gold stands out as a gold IRA provider due to its expertise, competitive pricing, and exceptional customer service. Not all precious metals are eligible for investment or storage in an IRA. That’s why Allegiance Gold is here to help educate you and answer any questions that you may have. Open AccountBest for Diverse Storage OptionsStar rating: 4. They are not broker dealers, and they are not the custodians of the gold that investors buy. The company has a long standing reputation for its expertise in silver investments and offers a wide range of silver IRA options. Before you invest in a precious metals IRA, you should understand the distinction between traditional IRAs and precious metals IRAs. Madison Trust has a secure and simple six step process, and we work directly with FideliTrade and Delaware Depository on all gold IRA trades.

Address

BMOGAM Viewpoints strives to keep its information accurate and up to date. Best for Diverse Storage OptionsStar rating: 4. The client chooses which trust company he or she wants and then submits the completed paperwork by e mail, fax, overnight courier, or standard US Mail. Precious metals, Gold American Eagles, Proof Gold American Eagles, certified gold coins, as well as gold and silver bars carry risk and investing in precious metals directly or through an IRA is not suitable for all investors. Be sure to research reputable dealers before investing in gold or silver with your Roth IRA funds. They won’t do this to anyone else who calls in to sell proof coins. For the best experience on our site, be sure to turn on Javascript in your browser. Typically, these companies charge three types of gold IRA fees. These are just three examples of the kinds of investments that can lead the investor away from the stability of conventional coin and bullion investments and generally should be avoided by investors whose goals include building a hedge against economic certainties or a long term store of value. Secure Your Financial Future with the Patriot Gold Club. You will need to invest some of your savings in assets that will hold their value even in the worst economic conditions. Once your money has been transferred over, you may choose to add gold and silver coins and bars.

Call IRA Innovations at 205 985 0860 and get started on your self directed IRA today

18% annual storage rate $174 minimum for segregated. A custodian firm administers the account and handles all aspects from purchasing to storing the gold according to the account holder’s directions. Users do not receive a choice of custody partner. Reply STOP to opt out from text messages. Many clients think silver is an excellent long term investment and inflation hedge and want to include it in their retirement portfolio. The company offers a range of secure payment options and provides a safe and secure environment for customers to make their transactions. We are happy to work with our customers on their retirement planning needs, and we have the resources necessary to make the process hassle free. Noble Gold’s commitment to customer satisfaction has earned them a reputation as one of the best gold IRA companies. Goldco is proud to offer this 2022 silver Mighty Mo coin. Here are the answers to frequently asked questions about gold and other precious metals in an IRA. American Hartford Gold.

About Kitco Metals

Silver IRAs are approved by the Internal Revenue Service and are a great way to diversify your retirement savings. The company works with knowledgeable account managers committed to providing a hassle free customer experience. When you retire and begin taking withdrawals from your IRA, the money you withdraw will be taxed as ordinary income. Unlike paper investments, silver bullion provides a physical presence that can be held, traded, and stored securely. Users won’t find many order types beyond basic market and limit orders, which prevents more complex traders from getting the most out of the system. Augusta Precious Metals have consistently proven that it can retain customers throughout the life of its investment. It is important to check with the gold IRA company to determine which types of gold are eligible for purchase and storage in the account.

FEATURED POSTS

You may place an order online 24/7/365, or by phone at 361 594 3624, Monday through Friday between 8 a. Grow Your Wealth With American Hartford Gold Group. Advantage Gold’s commitment to excellence has earned them a top rating among gold IRA companies. On calling the company back at a later date, the representative remembered our name and the information that we were following up on. With a commitment to excellence, they have a well earned reputation as a trusted and reliable source for precious metals investments. Choosing a precious metals IRA company is the first step in investing. And when it comes to funding your account, you’ll have multiple options for doing so. The process of investing in a gold IRA can vary according to the company you select. Investing in precious metals through an IRA is tax deferred. Accurate Precious Metals Coins, Jewelry and Diamonds can assist in establishing Gold or Silver IRA accounts that allow individuals to store physical bullion coins/bars instead of paper assets as part of their retirement plan. Why stop at precious metals. To get started, take our free diversification quiz.

All that Glitters Might Be Gold, Silver, Platinum, or Palladium

He extended his expertise beyond the scope of the business deal and I look forward to contacting Brent for my next home purchase. Diversifying your retirement portfolio with gold and silver is a wise investment decision. One way to do this is to look for reviews and ratings of the companies. Our relationships with some of these companies may affect the order in which they appear. Accurate Precious Metals makes this process simple and stress free. Investors must understand the benefits of investing in precious metals with an IRA. Best Gold IRA Companies. What Are the IRS approved Coins Can You Hold in a Gold IRA.

Subscriptions

For instance, if you want, you can invest in the firms that directly mine these precious metals by buying company shares. It always shows the most current precious metals pricing, so you can compare yourself against other dealers. 5 years old and have a current 401k through an existing employer, you may be eligible for an “in service” distribution, allowing you to do a partial gold IRA rollover. Home » Self Directed IRAs » Self Directed IRA Investment Options » Self Directed Gold and Precious Metals IRAs. Gold IRAs allow investors to own physical gold, silver, platinum, and palladium, as well as other precious metals. A hard money loan is a type of loan that is secured by real estate and is considered somewhat difficult to acquire. Discover the Benefits of Investing with American Hartford Gold Today. Most financial advisors recommend limiting gold to a small portion of a balanced portfolio. Precious metals carry capital risk.